The cost of ETH, the native cryptocurrency of Ethereum, achieved a record-high on CME releasing dedicated futures.

The cost of Ether (ETH), the indigenous Free cryptocurrency Course of Ethereum, achieved a brand-new all-time high up on Feb. 9, 2021. On Binance, ETH rallied to as high as $1,830 merely hrs after it began to trade on CME.

Why is ETH rallying after the CME listing of any kind of relevance?

The timing of the ETH rally to a brand-new record-high is significant due to the adverse belief around it prior to the listing.

In December 2017, CME provided the Bitcoin futures contract for the first time. Within weeks, the price of Bitcoin crashed from $20,000 to around $6,000.

Lots of investors and experts were expecting ETH to fall in a comparable manner to BTC after Bitcoin futures went live on the CME in December 2017.

However, there are 2 misunderstandings about this concept. There is no method to show that the CME Bitcoin futures listing was the driver that created BTC to plummet in the weeks that complied with.

Second, other than that unprovable concept, there is no clear factor to perceive CME noting ETH as a bearish event.

The distinction in between 2021 as well as 2017 is that there is unmatched institutional need for Ether and also cryptocurrencies as a whole. As Cointelegraph reported, Tesla acquired $1.5 billion worth of Bitcoin, which is nearly 10% of its money holdings.

There is a solid possibility that the institutional need for Bitcoin can convert right into climbing demand for ETH. In this feeling, the CME listing could be a significant stimulant for Ethereum in the longer term.

Ryan Seans Adams, an Ethereum investor as well as researcher, stated:

” ETH futures go survive on the CME today This is significant. This is a bridge to institutions. This is a thumbs-up from U.S regulatory authorities. ETH is becoming globally accepted asset money.”

CME listing will certainly be a catalyst for Ethereum

Scientists at the CoinMetrics group said in a note that they think CME’s ETH futures launch might speed up inflows of ETH right into the Grayscale Ethereum Depend On (ETHE).

This would likely cause both the short-term as well as long-term sentiment around ETH to swiftly boost if the institutional appetite for Ethereum increases as an outcome and Grayscale inflows surge. The scientists stated:

” CME’s launch may potentially speed up ETH inflows right into Grayscale’s Ethereum Count on (ETHE) – financiers can buy into the Grayscale Count on while simultaneously shorting ETH, staying market neutral as well as taking the ETHE premium. Grayscale’s Ethereum depend on does not currently have an approach for withdrawing ETH so it effectively functions as a big token sink for ETH.”

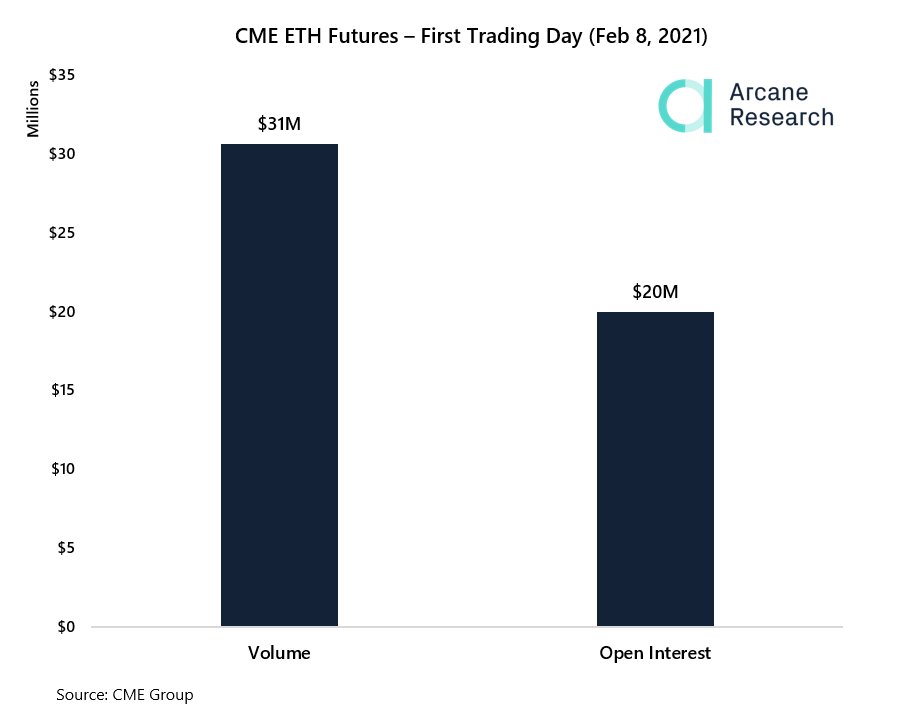

Experts at Arcane Study located that the ETH futures contract attained a $30 million day-to-day quantity on its initial day, which is reasonably high.

As the volume remains to increase, it would show that organizations are also taking into consideration ETH as a prospective investment. The experts stated:

” ETH Futures launch on @CMEGroup Financial institution The first day of trading for CME’s ETH Futures finished with over $30 million in volume as well as $20 million in open interest.”